Andie Creel

I am an environmental economist completing my PhD at the Yale School of the Environment. My research estimates the non-market value of nature-based adaptation solutions to climate change, ecosystem services, and biodiversity, with a focus on integrating these values into the systems that measure welfare, business performance, and fiscal health. I combine behavioral data, such as credit card transactions, mobility records, and time-use surveys, with high-resolution environmental data to reveal how natural resources influence well-being and economic outcomes.

I will be on the job market in 2025-2026.

Research

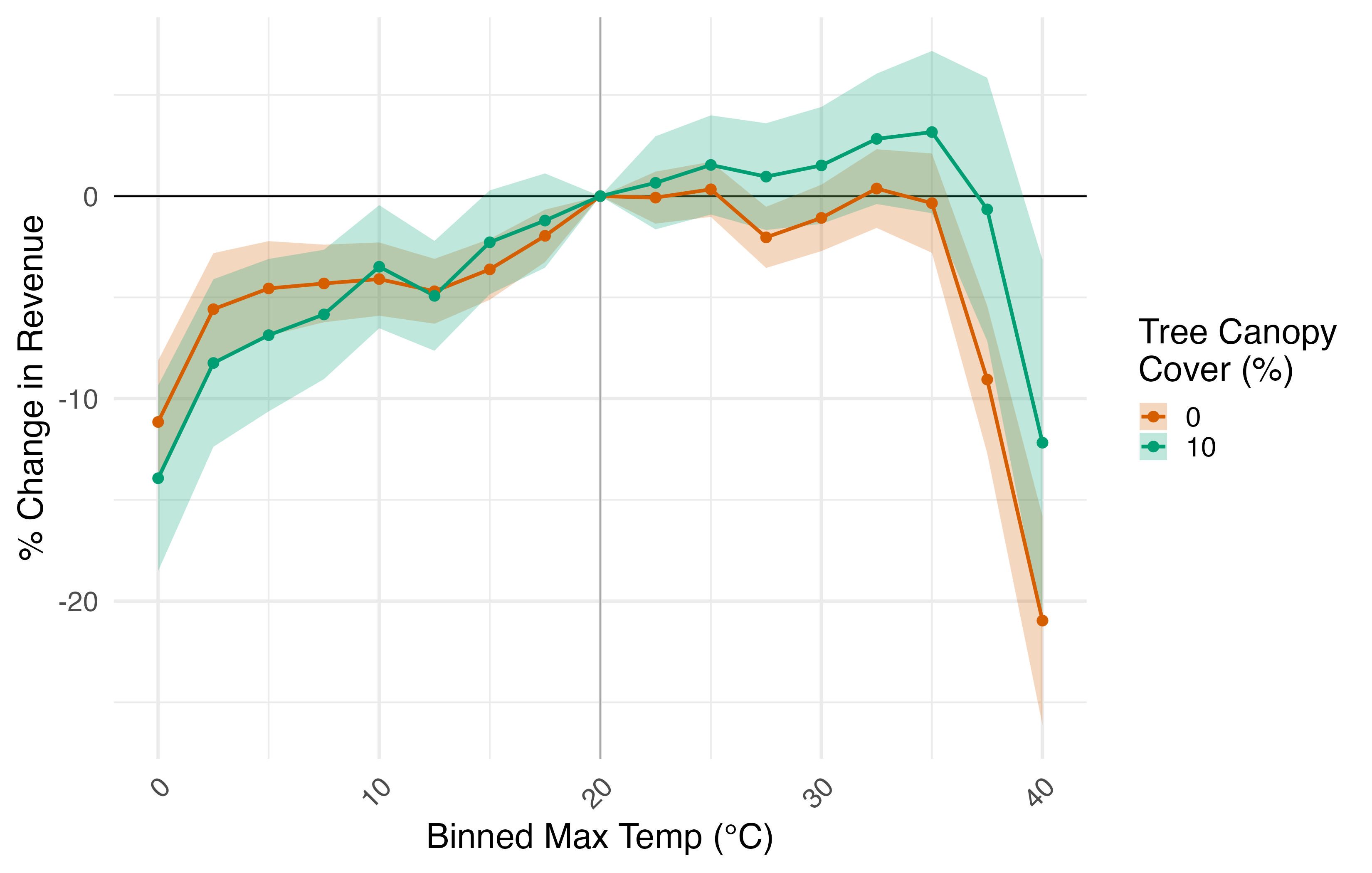

Job Market Paper: The Value of Nature-Based Adaptation – Evidence that Tree Cover Protects Urban Revenue from Heat

[Link to Working Paper.] Climate change is increasing the frequency and intensity of extreme heat events, particularly in cities. This paper estimates the causal effect of temperature on daily revenue using over 15,000 consumer-facing storefronts in the 49 largest U.S. cities between 2019 and 2023. Above 35 °C (95 °F), revenue falls steeply, averaging 9 percent lower on days above 37.5 °C (99.5 °F) days than on 20 °C (68 °F) days. Consumption smoothing across days mitigates some damage from an extreme heat event, but a 1.3 percent revenue drop persists for two weeks following a hot day. Therefore, I estimate how effective urban green space is as a climate adaptation strategy that can prevent revenue losses caused by extreme heat ex ante. I find that a one percent increase in tree cover surrounding a storefront increases revenue by 0.94 percent on hot days. A 10 percent increase in surrounding tree cover eliminates revenue losses at 37.5 °C and reduces them by half at 40 °C, relative to areas without canopy. Storefronts located in the Southwest and South have the most to gain from urban tree cover. On average, businesses in this region can cover the cost of moving to a 10 percent tree cover scenario in four years with the avoided revenue losses. This length of time shortens under projected climate scenarios. These results suggest that green infrastructure can improve firm resilience to heat, providing evidence of a private incentive to finance urban green space that could simultaneously provide a positive externality.

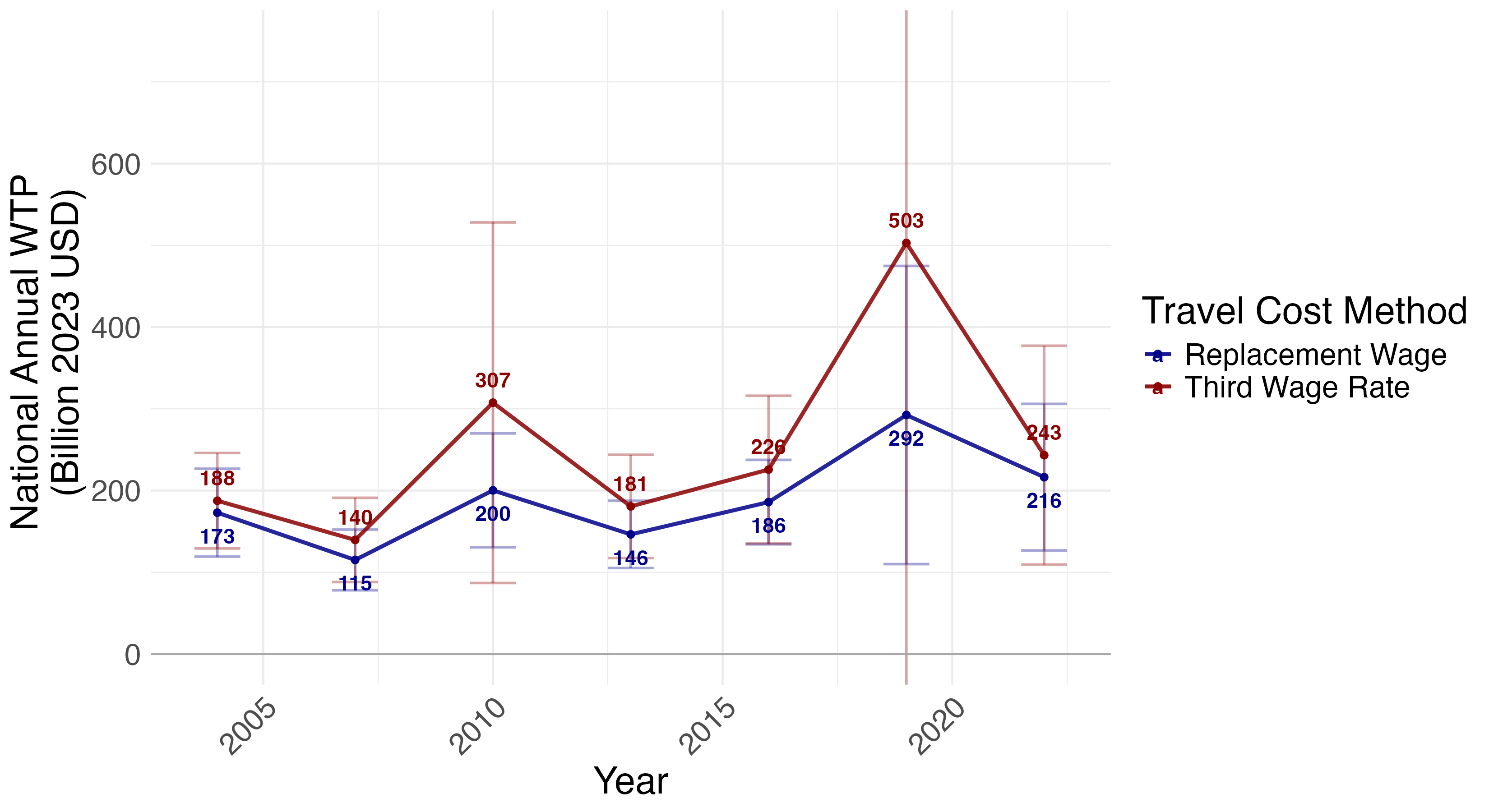

The National Value of Local Outdoor Recreation over the Past 20 Years

[Link to Working Paper.] I estimate the value of local outdoor recreation in the United States from 2003 to 2023 using the American Time Use Survey and a travel-cost model. I track changes in value over time, which informs if the places that enable local recreation have been managed sustainably, and across demographic groups, which aids in assessing if these places are equitably distributed. I compare two approaches for pricing travel time: (i) welfare-based willingness to pay, valuing time at one-third of own wage, and (ii) accounting values using a replacement wage consistent with household production accounts. Average value per local recreation trip, which requires less than 30-minutes of travel time, is stable at $16–$18 (2023 USD), with temporary increases around the Great Recession and the COVID-19 pandemic. Scaling by trips and population, the national annual value is $231–$241 billion in 2023, roughly $100 billion higher than in the early 2000s. While aggregate trends are similar under both pricing approaches, distributional conclusions differ substantially: using a replacement wage compresses the richest quintile’s per-trip value from about 10 times larger than the poorest to only 1.5 times larger. I also use the framework from Drupp et al. (2024, 2025) to infer changes in the natural capital stock that enables recreation. Combining value-per-trip trends with consumption growth, I find that recreation-enabling assets have been roughly maintained over the past two decades, consistent with sustainable management at the national level. This paper produces a scalable, repeatable measure of local recreation benefits at the national level, connects non-market valuation with accounting-consistent pricing, and provides a practical tool for tracking growth of an ecosystem service’s enabling natural capital stock when direct measurement is infeasible.

Measuring the Value of Outdoor Recreation for National Environmental-Economic Statistics

With Jorge Forero Fajardo and Eli P. Fenichel

[Link to Working Paper.] The 2025 System of National Accounts establishes that comprehensive expenditure measurement across accounting boundaries can support welfare assessment. For ecosystem services like outdoor recreation, this requires comprehensive partitioning of expenditure between the System of National Accounts (SNA) boundary for market transactions and the household production boundary for travel time. Current U.S. satellite accounts fail to do this. The Outdoor Recreation Satellite Account captures only market expenditures for distant trips, while the Household Production Satellite Account excludes recreation entirely. We use detailed U.S. coastal recreation data to partition travel costs across these boundaries and quantify the resulting measurement gaps. Our central finding is that outdoor recreation is primarily a household-produced service. Travel time, not market purchases, represents the major expenditure. Household production values are approximately twice market expenditures, meaning assessments based only on market spending underestimate recreation’s contribution to well-being by roughly threefold. Including recreation travel time would increase the Household Production Satellite Account by 4–5 percent nationally ($12.4 billion in the Gulf Region, or 0.7 percent of regional GDP). These measurement gaps have policy consequences: benefit-cost analyses that rely solely on market expenditures systematically understate recreation benefits, potentially leading to underinvestment in environmental protection and recreational infrastructure.